Early success in live trading can be intoxicating. Quick profits validate months of backtesting, forward testing, and tweaks. But what happens when that “validated” strategy hits a wall of drawdowns and never regains its peak? This Natural Gas futures strategy deployment offers a stark reminder: Short-term performance is a liar. True edge reveals itself only after 12+ months of live stress-testing.

The Honeymoon Phase: Blasting Past ₹3 Lakhs

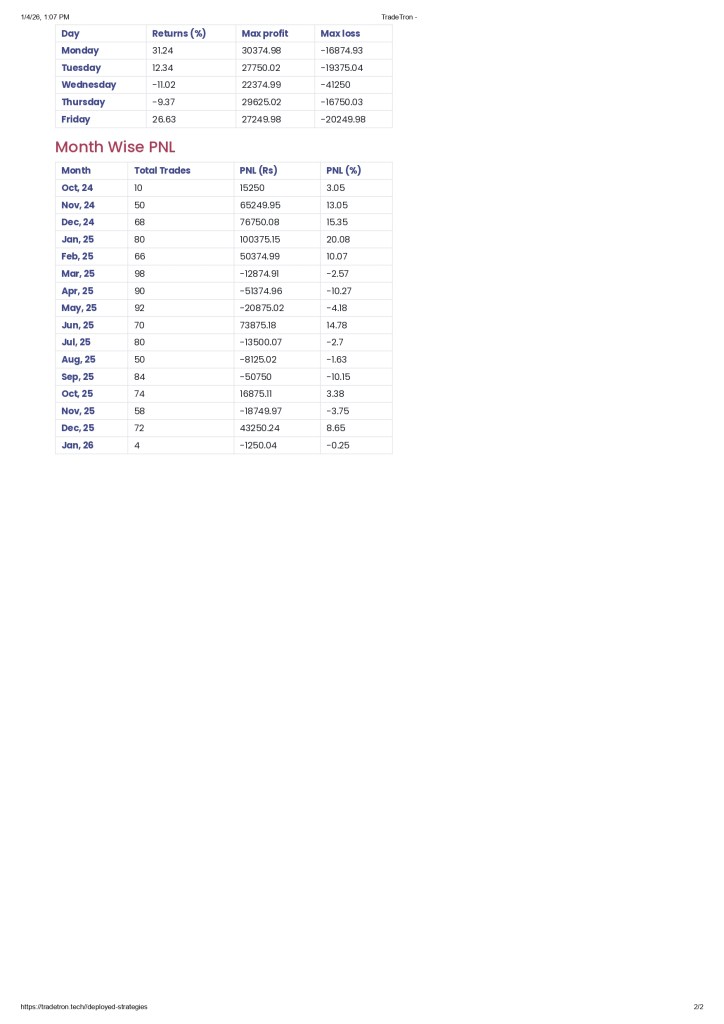

Deployed on Tradetron (strategy link: tradetron.tech/strategy/6657678) with ₹5L capital, this 0900-105 Natural Gas futures setup (SL ₹20k, skips Wed/Thu) exploded out of the gate. From Nov 2024 to Jan 2025, it piled on massive gains:

- Jan 2025: ₹1,00,375 (20.08% ROI)

- Cumulative peak: Crossed ₹3 lakhs profit in the first few months.

The equity curve looked like a rocket then by March 2025.

The Brutal Reality: 9 Months of Drawdowns, No New Highs

Then… silence. For the next 9 months (Mar-Dec 2025), the strategy endured multiple drawdowns, with a brutal max DD of ₹1,58,875 (18.70%). Key offenders:

| Month | P&L (₹) | ROI % |

| Apr 25 | -51,375 | -10.27 |

| Sep 25 | -50,750 | -10.15 |

| Mar 25 | -12,875 | -2.57 |

Despite total profit reaching ₹2,64,501 (52.90% ROI) and Sharpe 1.41, it never crossed the initial ₹3L high. Avg monthly profit: ₹19,022, but volatility (32.42% ann. std dev) ground it down. Max loss day: -₹41,250.

Defining “Short-Term”: The Data Says 3-6 Months Is a Trap

This isn’t theory—it’s empirical:

- 3 months: Peak euphoria. Ignores regime shifts.

- 6 months: Feels “long enough.” Still misses seasonal cycles, vol clusters.

- 9 months: Exposed, but incomplete (one full commodity cycle?).

The strategy’s 292 trading days (~14 months) reveal the truth: Early wins masked underlying fragility. Lesson: Minimum 12 months forward/live testing before scaling conviction.

Why Long-Term Testing Separates Winners from Casualties

Markets aren’t stationary. Natural Gas faces:

- Seasonal demand swings (summer AC vs. winter heating).

- Geopolitical shocks (Ukraine, Middle East).

- Macro regimes (rate hikes crush commodities).

Short tests catch none of this. A 1-year filter ensures:

- Exposure to full cycles (bull/bear/flat).

- Drawdown survival proof.

- Statistical significance (enough trades for edge decay detection).

The Iron Rule: 12 Months Minimum Before Live Scaling

My rule, forged in drawdown fire:

- Backtest: 5+ years, multiple regimes.

- Forward test: 6 months minimum.

- Live test: 12 months minimum at small size before scaling. Watch for: peak recapture time, consecutive losing months, vol-adjusted returns.

Final Verdict: Patience Is the Ultimate Edge

“Never trust short-term.” Here, “short-term” means anything under 12 months. The market rewards those who wait for the full picture. Your strategy might peak at ₹3L in month 3… or grind sideways for 9 more. Test long, deploy slow, scale smart.

Leave a comment