Dear Subscribers,

I want to share a clear, unfiltered view of what has happened in my trading over the last six weeks—not just the results, but the real process behind them.

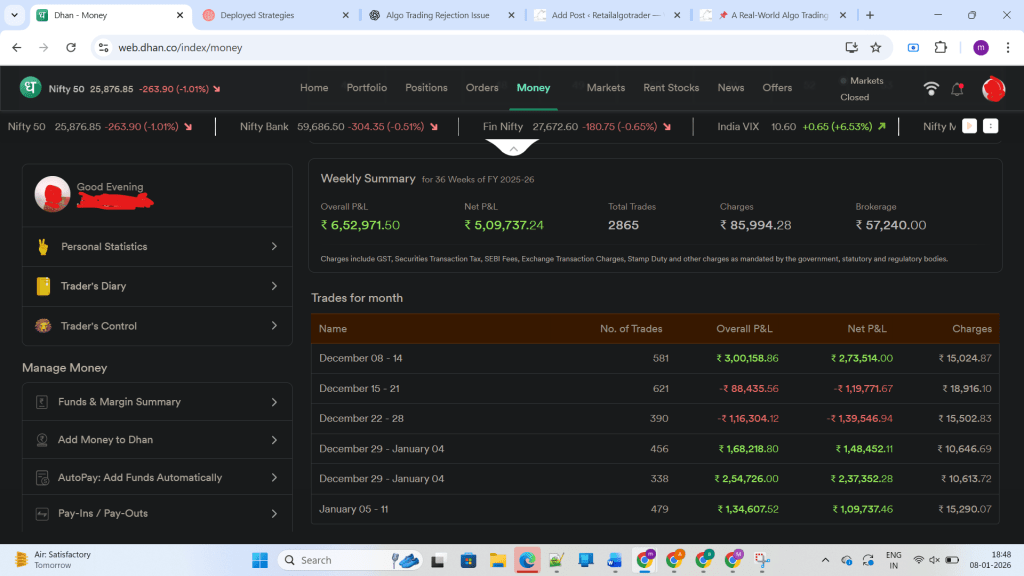

📈 The Headline Number

- Net P&L (last 6 weeks): ~₹5,00,000

- Capital deployed: ~₹35,00,000

These results did not come in a straight line.

🔻 Two Consecutive Losing Weeks — Yes, That Happened

Out of the last six weeks:

- Two weeks were consecutive losing weeks

- Losses were not only market-driven

- A significant portion came from execution and system-level issues

This is important to understand because real algo trading is not just about strategy logic—it’s also about execution reliability.

⚙️ The Problems I Faced (Openly Explained)

Over these weeks, I encountered multiple challenges:

1️⃣ Execution Errors (Platform & Coding Level)

- Orders not firing as expected

- Partial deployment (e.g., 4 stocks instead of intended 8)

2️⃣ Repair Logic Limitations (Earlier)

- Initially, only one repair entry was coded

- Strategy required continuous repair, not a single repair

- This was fixed by implementing a continuous repair function

3️⃣ Market Data Issues

- Stock prices not updating continuously

- This affected targets and stop-loss execution

- I attempted to shift logic to option-price-based execution

- That approach could not be fully implemented due to platform constraints (Tradetron)

- but Algotest platform solved the above issue.

4️⃣ Manual Intervention Became Necessary

- Whenever an error occurred, I manually repaired and completed the trade

- Strategy logic continued, but…

- This required continuous monitoring, which is not ideal but became necessary during system evolution

🧩 Platform Reality: Why I Use Both Tradetron & Algotest

- Many of the above issues are significantly reduced on Algotest

- Some issues still exist on Tradetron

- As of now, I am running strategies on both platforms

- No emotional decisions, no sudden shifts—only measured evaluation

This is real trading, not marketing trading.

🧠 A Very Important Clarification

Let me be absolutely clear:

I am NOT saying

“There will be no more losing weeks.”

That would be dishonest.

What I am saying is:

- The specific problems I faced

- The solutions I implemented

- The lessons I learned

Losing weeks—and sometimes even losing months—are normal and unavoidable in systematic trading.

They are not a failure of strategy or discipline.

They are part of the strategy lifecycle.

📚 Continuous Learning Is Non-Negotiable

I still consider myself a continuous learner of the markets.

Every issue I faced:

- Made the system stronger

- Improved risk awareness

- Enhanced execution discipline

- Increased transparency with subscribers

Markets evolve.

Platforms evolve.

Strategies must evolve.

And so must the trader.

🤝 Why I Share All This With You

Because you are not just following signals—you are:

- Participating in a real trading journey

- Experiencing real drawdowns

- Benefiting from real system improvements

There are no perfect equity curves.

There are only honest traders who adapt.

🧘 Final Thoughts

Profits bring confidence.

Losses bring clarity.

Survival brings mastery.

We will have winning weeks.

We will have losing weeks.

What matters is process, risk control, and transparency.

Thank you for trusting the journey—not just the results.

— Madhu Babu

Algo Trader | Strategy Developer | Continuous Student of Markets

Leave a comment