Track REAL Live Results Before You Deploy a Single Rupee

If you are still believing paper trading and back-testing screenshots, this blog is for you.

I learned this lesson the hard way—early in my trading journey, just like most retail traders. Today, after years of live auto-trading, I can confidently say:

Paper trading creates confidence.

Live trading creates character.

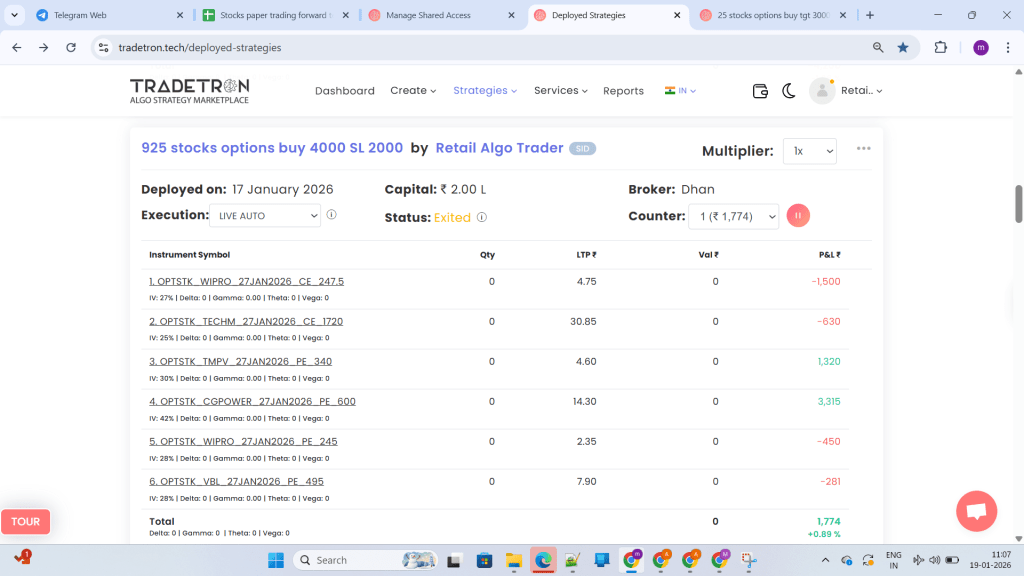

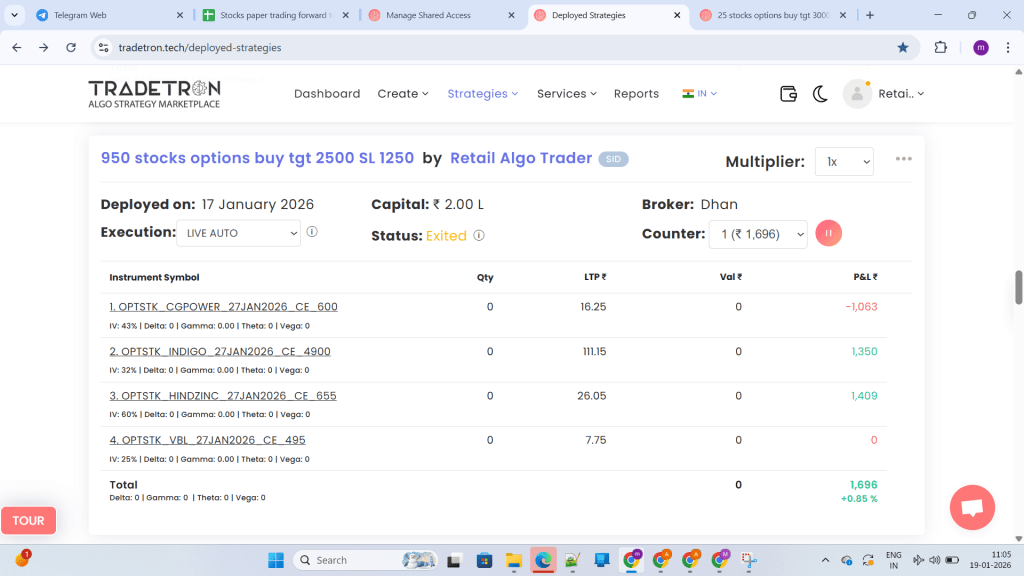

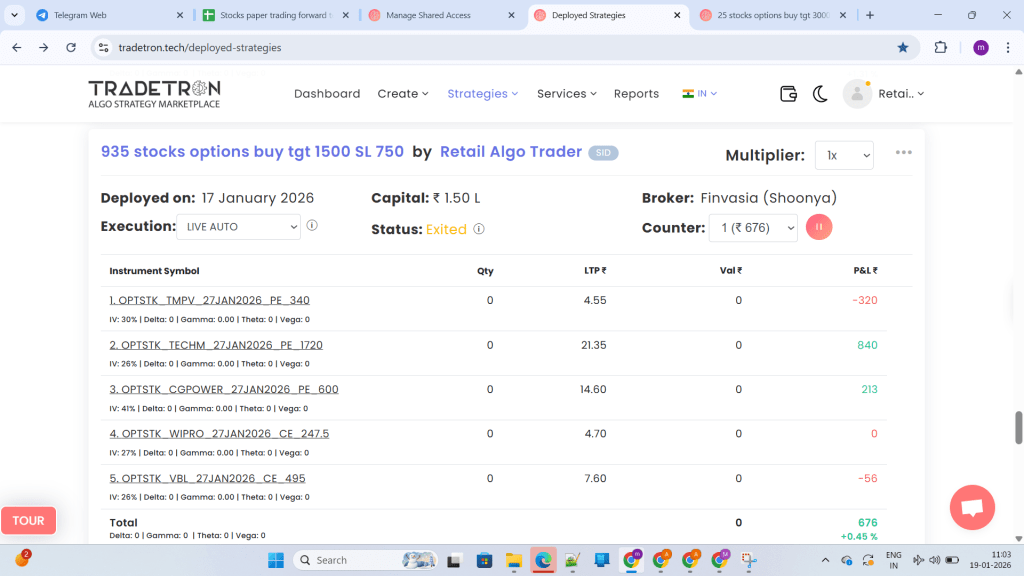

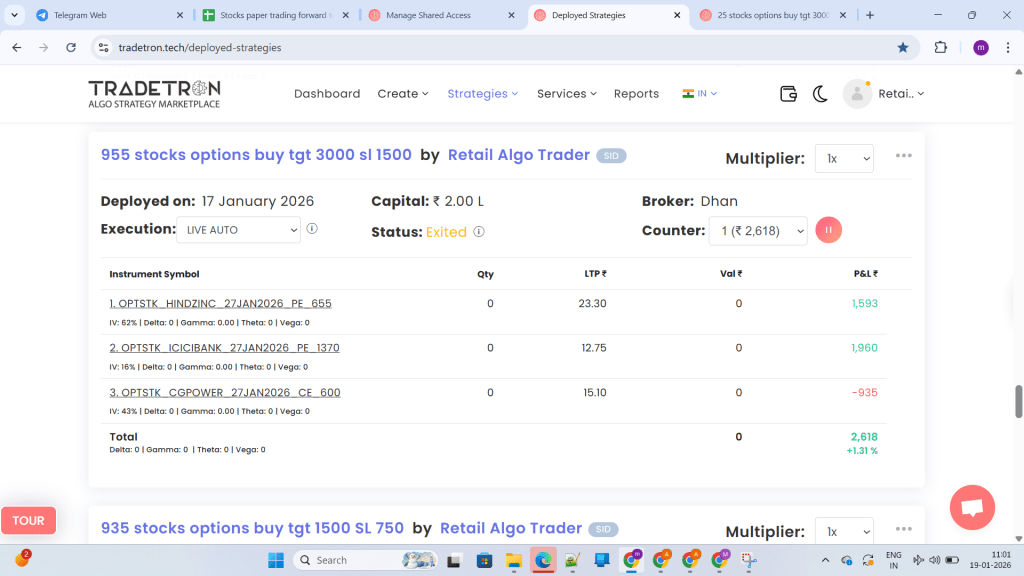

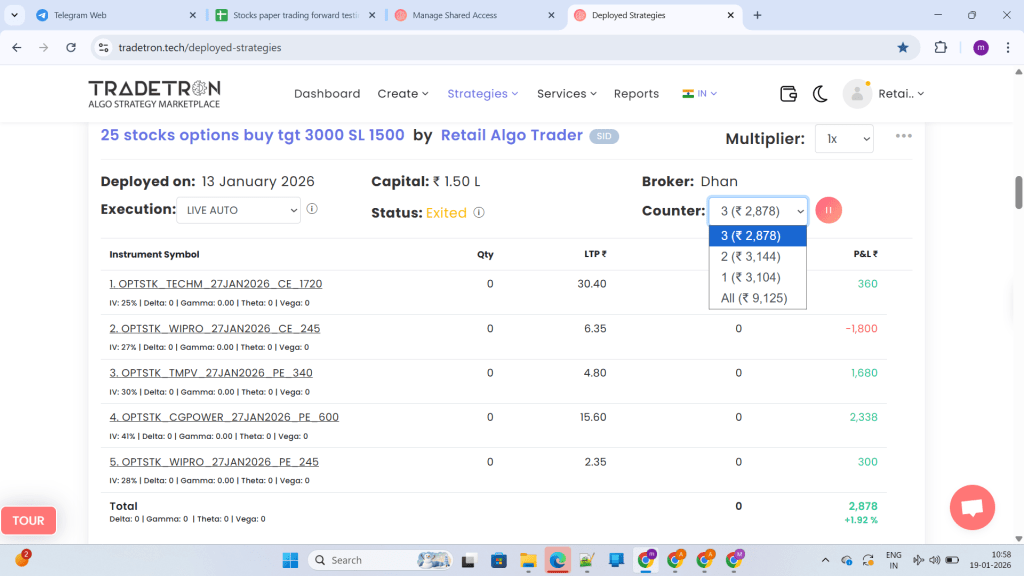

What you see below are REAL deployed strategies, REAL exits, REAL profits, and REAL losses—executed in LIVE AUTO mode on Tradetron with real brokers like Dhan and Shoonya.

No repainting.

No hindsight.

No simulation fantasy.

Why I Share LIVE Tradetron Codes (Not Just P&L Screenshots)

I am openly sharing LIVE SHARED CODES of my stock options strategies so that:

- You can monitor them yourself

- You can track long-term consistency

- You can experience real slippage

- You can decide without emotional pressure

👉 No paid commitment first. Only observation.

🔐 Live Shared Codes (Track in Real Time)

0086ed89-4029-4d1a-a7aa-9dcc0d52cad6 692e0ead-7593-472c-a776-81149ec5fe9d 6e5aabab-9244-4fb1-b917-b9c7dd5d5d56 3f288154-7598-4859-b878-b83e0f939735 ee4b0743-d9c8-44ff-8cd0-2a64396b1462 07392702-f9ed-49b7-b4f9-53908292f15e 40c081fd-0323-44d0-b543-4b4e75b60a28 a0eef6c2-576f-434a-a0bc-2dd3e40517c7 These are stock options BUY strategies with:

- ✅ Small Stop Loss

- ✅ Small, repeatable targets

- ✅ Capital-protected mindset

- ✅ Designed for consistency, not lottery trades

A Hard Truth Most Sellers Won’t Tell You

🚨 Slippage Is REAL — And It’s HUGE

Let me be very clear and honest:

There is significant slippage in live markets.

Reasons can be:

- Broker execution delays

- Tradetron infrastructure latency

- Option illiquidity

- Micro-second volatility spikes

- Bid-ask spread expansion

⚠️ No backtest or paper trade can capture this reality.

That’s why:

- Backtests look perfect

- Paper trades feel easy

- Live trading feels brutal

But only live trading shows the truth.

What These Live Deployments Prove

From the screenshots you saw:

- Multiple strategies deployed simultaneously

- Different capital sizes (₹1L – ₹2L)

- Different counters and brokers

- Exited trades with real P&L

- Both profits and controlled losses

This is not luck.

This is process + discipline + risk control.

Who Should Follow My Strategies?

✅ Traders who believe in long-term observation

✅ Traders tired of fake equity curves

✅ Traders who respect small losses and repeatability

✅ Traders who want transparent live tracking

❌ Not suitable for:

- “One-day double money” seekers

- Screenshot-hunters

- Emotional over-traders

My Advice to You (Very Important)

👉 Do NOT deploy immediately

👉 Track these live shared codes for weeks

👉 Understand slippage behaviour

👉 Observe consistency, not one-day P&L

If—after observing—you find value and confidence, only then deploy.

That’s how professionals grow.

Join the Community (Live Updates & Transparency)

📢 Telegram Group (Live updates & discussions):

👉 https://t.me/+m84g54AGaAlhMjhl

🌐 Website (Live codes, blogs, strategy philosophy):

👉 https://retailalgotrader.technology/

Final Words

Paper trading trains hope.

Live trading trains discipline.

I choose discipline.

I invite you to observe, verify, and then decide.

If you want real algo trading, not marketing fiction—

you are already in the right place.

— Retail Algo Trader

Leave a comment